This content is intended for the public covered by the exceptions of the Charter of the French language and its regulations. If you read on, you confirm that you fall within one of these exceptions.

SMBs and Large Corporations

Tax Credits

Development of E-Business

IMPORTANT

- Significant changes have been announced in the 2024-2025 Quebec Budget on March 12, 2024.

- Please see the « Important Changes for 2025» section below for more details.

This tax measure is designed to consolidate the development of information technologies (IT) throughout Québec. It enables specialized corporations that carry out innovative, high-value-added activities in the IT sector to obtain a tax credit of an annual maximum of $25,000 per eligible employee.

Details of Tax Assistance

Credit Rate

The tax credit is equal to 30% (24% refundable and 6% non-refundable) of the eligible salaries paid by the corporation to eligible employees.

Eligibility Criteria

Eligible Corporations

Your corporation may be eligible if the activities it carries out are primarily in the fields of information system design or software publishing and they are carried out in an establishment in Québec.

Your corporation must show:

- that at least 75% of its activities are in the IT sector1 and that at least 50% of these activities are covered by NAICS codes 541514, 541515, 513211, 513212 and, under certain conditions, 561320 and 561330, for the taxation year covered by the eligibility certificate application or for the prior taxation year;

- that at least 75% of its activities covered by NAICS codes 541514, 541515, 513211, 513212, 561320 and 561330 include services ultimately provided to persons with whom it is at arm’s length or services relating to applications developed by the corporation that are used exclusively outside Québec;

1 Activities in the IT sector mean activities covered by codes 334110, 334220, 334410, 417310, 449212, 513211, 513212, 51821, 541514, 541515 and, under certain conditions, 561320 and 561330 of the North American Industry Classification System (NAICS) 2022 version 1.0.

- that it maintained, at all times, for a given taxation year, a minimum of six eligible full-time employees; however, specific rules apply to transfers of activities and business start-ups in Québec.

Eligible Employees

To be eligible, an employee must hold a full-time job and devote at least 75% of his or her time to carrying out, supervising or directly supporting work relating to the execution of an eligible activity.

Eligible Activities

- IT consulting services relating to technology, systems development, or e-business processes and solutions that a corporation performs for a person insofar as the consulting services are related to the development, integration, maintenance or evolution of information systems or technology infrastructure, the design or development of e-commerce solutions, or the development of security and identification services that may be performed for that person.

- Development and integration as well as maintenance and evolution of:

- information systems (for instance, distribution packages, software and computer programs);

- technology infrastructure (for instance, technology architecture upgrading and integration of hardware and software components).

- Design and development of e-commerce solutions allowing for monetary transactions between the person on whose behalf this design or development was done and that person’s customers.

- Development of security and identification services (for instance, electronic imaging, artificial intelligence and interface) relating to e-commerce activities (for instance, security over Internet networks).

Examples of Excluded Activities

- Operation of an e-business solution (for instance, processing of electronic transactions over a transactional website)

- Management or operation of information systems, applications or infrastructures arising frome-commerce activities

- Operation of a customer relations centre

- Hardware installation and training activities

- Activities not related to e-business

- Administrative tasks

- Activities related to a marketing information system and designed to increase a corporation’s visibility and promote its goods and services to current or potential customers

Eligible Salaries

The eligible salary refers to employment income generally calculated pursuant to the Québec Taxation Act. It is the salary paid to an eligible employee, up to an annual limit of $83,333.

Specific Requirements

To be entitled to the tax credit, your corporation must obtain a corporation certificate and an employee certificate from Investissement Québec every year.

Fees

Fees are charged for the analysis of all eligibility certificate applications. For more information, contact an Investissement Québec advisor or see the rates schedule on our website.

How to obtain the tax credit

- Complete the applications for the corporation and employee certificates (in French) and send them to us after your company’s

year-end. - Once it has completed its review, Investissement Québec will confirm whether your company is eligible.

- If you have any questions, call one of our experts at

1 844 474-6367.

Fees are charged for processing all eligibility certificate applications.

Documents

- Detailed Fact Sheet (in French)

- Rates Schedule (in French)

Forms

New version dated September 2023

These corporations may not use a prior version of this form after December 31, 2023. If they do, Investissement Québec will require a new application to be filed, resulting in processing delays.

Want to receive your refund right away?

If your company is eligible for this tax credit, you may want to apply for financing for refundable tax credits to put your cash to work sooner. For more details, please contact one of our financing experts at

1 844 474-6367.

New for 2025

Important Changes for 2025Expand/Collapse

Here is a summary of the direction of fiscal measures of the modifications announced on March 12, 2024 by the Ministry of Finance of Quebec as part of the speech on the 2024-2025 Budget:

- Removal of the $83,333 limit applicable to the qualified wages of an eligible employee;

- Introduction of an exclusion threshold per eligible employee in the calculation of the tax credit. A qualified corporation will have to subtract, for a taxation year, from the amount of qualified wages incurred and paid in respect of an eligible employee, the amount corresponding to the excluded wages for that taxation year.

- The amount of excluded wages will be equal to the lesser of the following amounts:

- The amount corresponding to the qualified wages incurred and paid by a qualified corporation in respect of an eligible employee for the taxation year;

- The amount corresponding to the exclusion threshold applicable to qualified wages for the year, which corresponds to the amount taken into account in calculating the basic personal tax credit ($18,056 for 2024) for the calendar year in which the qualified corporation’s taxation year begins, adjusted to take into account the number of days in the taxation year of the qualified corporation where the employee qualifies as an eligible employee.

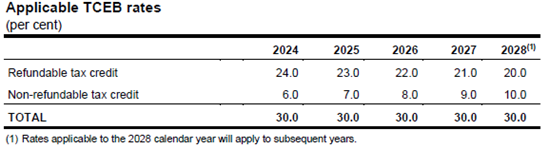

- The 6% rate of the non-refundable tax credit will be increased annually by 1 percentage point, until it reaches 10% in 2028. Similarly, the 24% rate of the refundable tax credit will be reduced annually by 1 percentage point until it reaches 20% in 2028.

- The table below shows the rates of the refundable tax credit and the non-refundable tax credit following the changes made.

Application date

- The changes relating to the introduction of an exclusion threshold and the removal of the limit will apply in respect of a taxation year beginning after December 31, 2024.

- Changes to the tax credit rates will take effect on January 1 of each calendar year concerned.

- A qualified corporation whose taxation year overlaps two calendar years, must take into account the rates in effect for the calendar year in which its taxation year begins in the calculation of tax credits.

April 2024