This content is intended for the public covered by the exceptions of the Charter of the French language and its regulations. If you read on, you confirm that you fall within one of these exceptions.

SMBs and Large Corporations

Tax Credits

Production of Multimedia Titles

IMPORTANT

- Significant changes have been announced in the 2024-2025 Quebec Budget on March 12, 2024.

- Please see the « Important Changes for 2025» section below for more details.

This measure is designed to encourage the production of multimedia titles in Québec. Eligible corporations can obtain a refundable tax credit.

Details of Tax Assistance

Credit Rate

The refundable tax credit may amount to 37.5% of eligible labour expenditures.

Eligibility Criteria

Eligible Corporations

Your corporation may be eligible if it has an establishment in Québec and produces eligible multimedia titles.

Eligible Multimedia Titles

- Titles must be published on an electronic medium, controlled by software allowing interactivity, and contain a substantial volume of three of the following four types of information: text, sound, still images and animated images. Video images are considered as only one media component.

- Related titles such as digital animation films associated with an eligible multimedia title produced by your corporation are also eligible. However, the labour expenditure related to the main multimedia title with which the related title is associated must be at least $1 million.

Eligible Production Work

Eligible production work in relation to a title refers to work carried out for the purpose of completing the production stages of the title, commencing with the design stage and indefinitely thereafter.

Eligible Labour Expenditures

Expenditures must be incurred by the producer for eligible production work. Eligible labour expenditures include all of the following amounts:*

- Salaries and wages paid to eligible employees;

- The portion of amounts paid to a subcontractor not dealing at arm’s length with the multimedia producer for the execution of eligible production work by employees of the subcontractor in an establishment in Québec;

- 50% of amounts paid to a subcontractor dealing at arm’s length with the multimedia producer for the execution of eligible production work in Québec.

*Eligible labour expenditures are the labour expenditures specified here, less the amount of government or non-government assistance related thereto.

Specific Requirements

To be entitled to the tax credit, your corporation must first have a valid initial qualification certificate issued by Investissement Québec certifying that the title produced or to be produced satisfies the requirements in effect. Subsequently, your corporation must obtain, for every fiscal year for which it wishes to claim the tax credit, an annual eligibility certificate regarding the production work related to the eligible multimedia title.

Fees

Investissement Québec charges a fee for issuing initial qualification or eligibility certificates. For more information, contact an Investissement Québec advisor or see the rates schedule on our website.

How to obtain the tax credit

- Complete the application for an initial qualification certificate (in French) and the Application for a Production Work Certificate (General Component) (in French) and send them to us.

- Once it has completed its review, Investissement Québec will confirm whether your company is eligible.

- If you have any questions, call one of our experts at

1 844 474-6367.

Fees are charged for processing all eligibility certificate applications.

Documents

- Detailed Fact Sheet - General component (in French)

- Detailed Fact Sheet - Specialized corporations (in French)

- Rates Schedule (in French)

Forms

- Application for an Initial Qualification Certificate - General Component

(in French) - Application for a Production Work Certificate - General Component

(in French)

Want to receive your refund right away?

If your company is eligible for this tax credit, you may want to apply for financing for refundable tax credits to put your cash to work sooner. For more details, please contact one of our financing experts at

1 844 474-6367.

New for 2025

Important ChangesExpand/Collapse

Changes to the tax credits for the production of multimedia titles

Here is a summary of the direction of fiscal measures of the modifications announced on March 12, 2024, by the Ministry of Finance of Quebec as part of the speech on the 2024-2025 Budget:

- Removal of the $100,0001 limit currently applicable to a salary or wages covered by the definition of the expression “qualified labor expenditure” incurred and paid in the year by the corporation in respect of an eligible employee or by a subcontractor with whom it is not dealing at arm’s length at the time the contract is entered into. 1 An exception to the $100,000 limit is provided for up to 20% of the total number of eligible employes.

- Introduction of an exclusion threshold applicable to the salary or wages attributable to eligible production work in the calculation of the tax credit (general component and specialized component).

- The corporation will have to subtract an amount corresponding to the excluded salary or wages, for a taxation year, from the amount of salary or wages attributable to eligible production work that it incurred and paid in respect of an eligible employee for that taxation year. It will be the same for the portion of the consideration paid, under a contract, to a subcontractor with whom the corporation does not deal at arm’s length.

- The amount of excluded salary or wages will be equal to the lesser of the following amounts:

- The amount corresponding to the qualified wages attributable to eligible production work that a corporation or a subcontractor with whom the corporation does not deal at arm’s length has incurred and paid in respect of an eligible employee for eligible production work for the taxation year.

- The amount corresponding to the exclusion threshold applicable to qualified wages for the year, which corresponds to the amount taken into account in calculating the basic personal tax credit ($18,056 for 2024) for the calendar year in which the qualified corporation’s taxation year begins. This amount will be adjusted to take into account the number of days in the taxation year of the qualified corporation where the employee qualifies as an eligible employee.

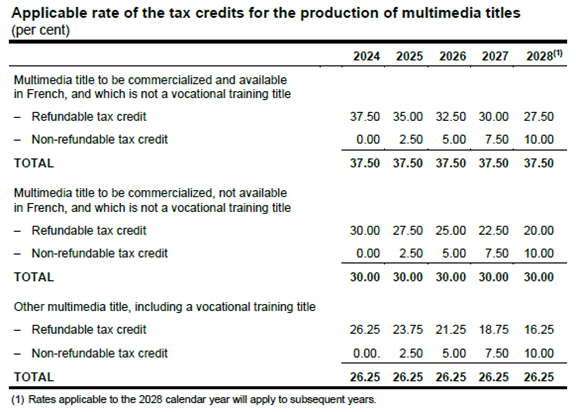

- Introduction of a non-refundable tax credit whose initial rate will be 2.5% in 2025, and which will subsequently increase by 2.5 percentage points per year to eventually reach10% in 2028, and correspondingly reducing the refundable tax credits currently in place.

- The table below shows the rates of the refundable tax credit and the non-refundable tax credit following the changes made.

Application date

- The changes relating to the introduction of an exclusion threshold and the removal of the limit will apply in respect of a taxation year beginning after December 31, 2024.

- Changes to the tax credit rates will take effect on January 1 of each calendar year concerned.

- A qualified corporation whose taxation year overlaps two calendar years, must take into account the rates in effect for the calendar year in which its taxation year begins in the calculation of tax credits.

April 2024